A WTF second in Silicon Valley#section1

Like everybody else who 1) has carried out consumer analysis, and a couple of) is over age 40, I spent the requisite decade or two wandering a wilderness inhabited by misguided people who assumed that, at finest, customers’ behaviors and opinions had been however minor issues within the design course of.

Article Continues Under

So think about my shock when, about 5 years in the past, I discovered myself trolling (AKA “consulting”) down the corridors of a giant Silicon Valley tech firm. You most positively know this firm—in truth, you’ve doubtless complained bitterly about your expertise with their merchandise. Naturally, I anticipated to seek out treasured little sensitivity there to customers’ wants, a lot much less any precise consumer analysis.

As an alternative I encountered a collection of strong, costly, well-staffed groups of researchers—many with doctorates—using nearly each conceivable technique to review the consumer expertise, together with (however not restricted to):

- Model structure analysis

- Name middle log evaluation

- Card sorting analysis

- Clickstream evaluation

- Area research

- Focus teams

- Market analysis

- Psychological mannequin mapping

- Internet Promoter Rating surveys

- Search analytics

- Usability testing

- Voice of the shopper analysis

The corporate had all this analysis into what their customers had been pondering

and doing. And but their merchandise had been nonetheless universally despised.

Why?

The fable of the blind males and the elephant#section3

You’ve heard this one earlier than. Some blind males stroll right into a bar… Later, they occur upon an elephant. One feels the trunk and pronounces it a snake. One other feels a leg and claims it’s a tree. And so forth. None can see the Massive Image.

Every of these groups is like a kind of blind males. Every does an incredible job at learning and analyzing its trunk or leg, however none can see the elephant. The result’s a disjointed, costly assortment of partial solutions, and a evident lack of perception.

Neglect Massive Knowledge—proper now, our greater drawback is fragmented knowledge that comes from siloed consumer analysis groups. Right here’s a easy instance: one group could depend upon behavioral knowledge—like a purchasing cart’s conversion charge—to diagnose a significant drawback with their website. However they will’t provide you with an answer. In the meantime, simply down the corridor, one other group has the instruments to generate, design, and consider the required answer. Sadly, they don’t learn about the issue. How come?

As a result of these two groups could not know that the opposite exists. Or they aren’t inspired by their group to speak. Or they don’t share sufficient frequent cultural references and vocabulary to have an affordable dialogue, even when they wished to. So synthesis doesn’t occur, the chance for game-changing perception is missed, and services proceed to suck.

I’ve since encountered the identical drawback in all kinds of industries and locations outdoors the Valley. Even comparatively small corporations like Aarron Walter’s MailChimp battle with fragmented consumer analysis.

Organizations that now spend money on consumer analysis should resist the urge to congratulate themselves; they’ve solely achieved Stage 1 standing. How can we assist them attain a better stage of their evolution—one the place the aim isn’t merely to generate analysis, however obtain perception that truly solves actual design issues?

I want there have been a pat reply. There merely isn’t.

However we are able to create situations that get these blind males speaking collectively. Consciously exploring and addressing the next 4 themes—steadiness, cadence, dialog, and perspective—could assist researchers and designers remedy the issues all that treasured (and costly) consumer analysis uncovers—even when their organizations aren’t on board.

Stability: Avoiding a analysis monoculture#section4

Simply as we favor the analysis instruments that we discover acquainted and cozy, giant organizations typically use analysis strategies that mirror their very own inner choice biases. For instance, an engineering-driven group could make investments much more in its toolsy analytics platform than what could seem to them as “nebulous” ethnographic research.

For those who’re solely listening to 1 blind man, you’ll be caught with an incomplete and unbalanced view of your prospects and the world they inhabit. That’s dangerous organizational habits: you’ll miss out on detecting (and confirming) attention-grabbing patterns that emerge concurrently from completely different analysis silos. And also you doubtless gained’t study one thing new and necessary.

A wholesome steadiness of analysis strategies and instruments provides you with an opportunity to actually see the elephant. Sounds easy, nevertheless it’s sadly unusual in giant organizations for 2 causes:

- We don’t know what we don’t know. For instance, you might need carried out dozens of discipline research, however know nothing about A/B testing.

- We don’t know what to make use of when. There are such a lot of potential approaches that it’s laborious to know which to make use of and the right way to optimally mix analysis strategies.

Loads of good books can introduce you to consumer analysis strategies outdoors your consolation zone. For instance, Observing the Person Expertise and Common Strategies of Design will assist you to stock analysis strategies from the human-computer interplay world, whereas Internet Analytics: An Hour a Day will do the identical for internet analytics strategies.

However a laundry checklist of various analysis strategies gained’t, by itself, let you know which strategies you ought to use to realize steadiness. To make sense of the large image, many sensible researchers have additionally begun to map out the canon.

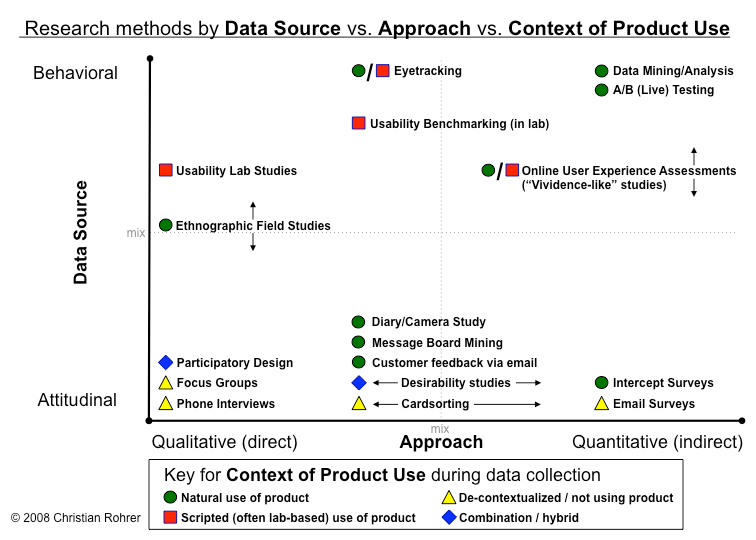

One of the in depth and helpful maps is Christian Rohrer’s “Panorama of Person Analysis Strategies.” It depicts analysis strategies inside 4 quadrants delineated by two axes: qualitative versus quantitative, and attitudinal (what individuals say) versus behavioral (what they do):

Use Christian’s “panorama” as an auditing instrument to your consumer analysis program. Begin with what you have already got, utilizing this diagram first to stock your group’s current consumer analysis toolkit. Then establish gaps in your analysis methodology. If, for instance, your entire consumer analysis strategies are clustered in one among these quadrants, it is advisable end up some extra—and a few completely different—blind males.

Cadence: The rhythm of questions and solutions#section5

Person analysis—like another type of effort to higher perceive actuality—doesn’t work effectively if it occurs solely every now and then. Your customers’ actuality is continually in flux, and your analysis course of must sustain. So what analysis ought to occur when?

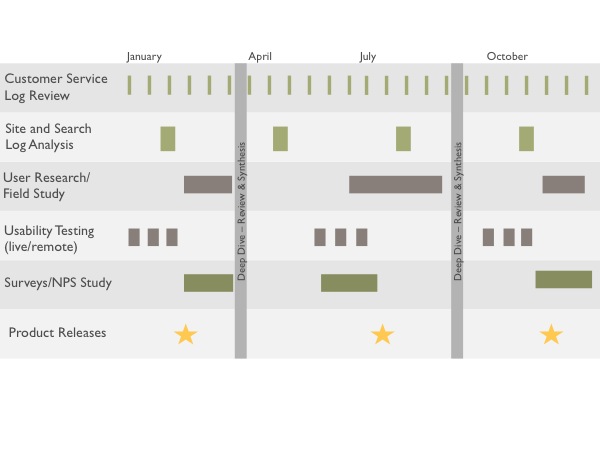

Simply as a map like Christian’s may also help you make sense of consumer analysis strategies spatially, a analysis cadence may also help you perceive them within the context of time. A cadence describes the frequency and period of a set of consumer expertise strategies. Right here’s a easy instance from consumer researcher and writer Whitney Quesenbery:

Whitney’s cadence incorporates a mixture of analysis strategies, offers us a way of their period, and, most significantly, maps out how steadily we must always carry out them. It helps us know what to anticipate from a company’s upcoming analysis actions, and work out how different varieties of analysis may match timewise.

To ascertain a cadence, first prioritize your group’s analysis strategies by effort and value. Easy, cheap strategies may be carried out extra steadily. You may also take a shortcut: search for (and consolidate) the de facto cadences already employed inside your group’s varied consumer analysis silos.

Then think about how steadily every technique might be employed in a helpful approach, given finances, staffing, and different useful resource constraints. Additionally search for gaps in timing: in case your analysis is coming in on solely a day by day or annual foundation, search for alternatives to assemble new knowledge month-to-month or quarterly.

Right here’s a pattern cadence. Provided that your group will make use of a distinct mixture of analysis strategies, your mileage will differ:

| Weekly | |

| Name middle knowledge pattern evaluation | 2 – 4 hours (behavioral/quantitative) | Activity evaluation | 4 – 6 hours (behavioral/quantitative) | Quarterly |

| Exploratory evaluation of website analytics knowledge | 8 – 10 hours (behavioral/qualitative) | Person survey | 16 – 24 hours (attitudinal/quantitative) | Yearly |

| Internet Promoter Rating research | 3 – 4 days (attitudinal/quantitative) | Area research | 4 – 5 days (behavioral/qualitative) |

I’ve added within the classes from Christian’s two axes to make sure that our cadence maintains steadiness.

Stability and cadence may also help organizations get the right combination of blind males speaking, and ensure they’re speaking frequently. However how will we allow dialogue between completely different researchers and get them to really share and synthesize their work?

Dialog: Getting researchers speaking#section6

Getting individuals to speak is simpler stated than carried out. In case your consumer researchers have HCI backgrounds and your analytics group is generally engineers, their languages and frames of reference could also be so completely different that they crush any hope of productive dialog.

Create a pidgin#section7

To make that dialog extra more likely to succeed, it’s useful to establish not less than a couple of shared references and vocabulary. In impact, look to develop one thing of a “consumer analysis pidgin” that permits researchers from completely different backgrounds to grasp one another and, ultimately, collaborate.

An idea from sociology, boundary objects, may be helpful right here. Boundary objects are two objects from completely different fields that, whereas not precisely the identical factor, are related sufficient that they will allow a productive dialog between teams. For instance, personas and market segments, or targets and KPIs, might be thought-about boundary objects.

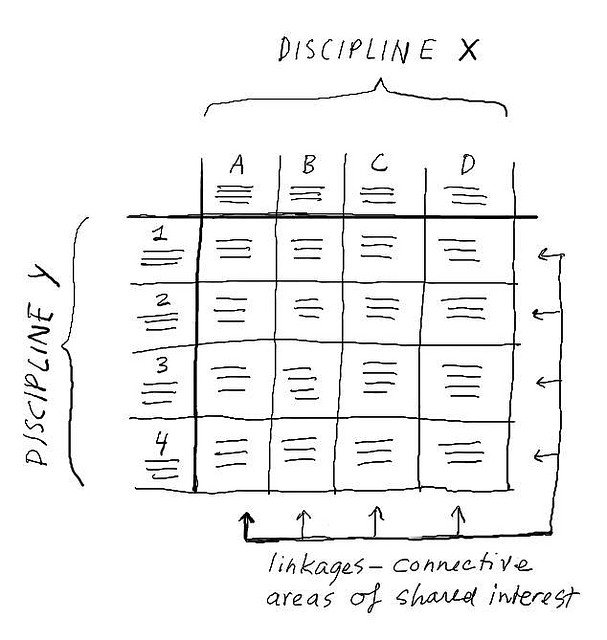

Dave Grey, co-author of Gamestorming and The Linked Firm, has taken the concept additional, growing a easy course of for figuring out a fuller boundary matrix of frequent ideas.

Whereas Dave’s course of will assist you to decide frequent ideas and vocabulary, it’s nonetheless a Massive Win to get broad acknowledgment that, when you and your colleagues could also be talking (for instance) English, you’re actually not talking the identical language in terms of consumer analysis. That realization will make it a lot simpler to fulfill one another midway.

Inform one another tales#section8

Widespread language makes it simpler to have an efficient interdisciplinary dialogue. So do tales that reveal the worth of that dialogue. Are you able to inform a narrative that exhibits the ability of getting the blind males to speak? Right here’s one Jared Spool—a grasp storyteller, for certain—advised me a decade or so in the past:

The analytics group at a big U.S. clothes retailer discovered, when analyzing its website search logs, that there have been many queries for the corporate’s product SKUs—and that they had been all retrieving zero outcomes. Horrified, they shortly added SKUs to their catalog’s product pages—a straightforward repair for an enormous drawback—however they nonetheless couldn’t perceive how prospects had been discovering the SKUs within the first place. In any case, they weren’t displayed wherever on the location.

The analytics group might inform what was happening, however not why. So that they enlisted the group answerable for performing discipline research to discover this situation additional. The sphere research revealed that prospects had been truly counting on paper catalogs—an outdated, acquainted standby—to browse merchandise and acquire SKUs, after which coming into their orders by way of the newfangled web site, which was deemed safer and simpler than ordering by way of a toll-free quantity.

The story could also be an attention-grabbing instance of cross-channel consumer expertise. However for our functions, it’s an effective way to point out how two very completely different consumer analysis strategies—search analytics and discipline research, wielded by utterly separate groups—ship compounded worth when used collectively.

Purchase sweet for strangers#section9

After all, generally it’s not that onerous to get interdisciplinary dialogue going; you simply may must resort to some harmless bribery.

Samantha Starmer, who led design, info structure, and consumer expertise teams for years at REI, relates her expertise in creating dialogue along with her counterparts within the advertising and marketing division. Samantha made some extent of frequently trekking throughout the REI campus over to their constructing to peek on the analysis that they had posted of their battle rooms and cubicle partitions. She would even purchase sweet for the advertising and marketing individuals she wished to get to know. She did no matter she might to get them speaking—and sharing—in a casual, human approach.

Samantha’s guerrilla efforts quickly bore fruit—her group developed relationships not simply with advertising and marketing, however everybody touching the shopper expertise. Casual lunches led to common cross-departmental conferences and, extra importantly, sharing analysis knowledge, new initiatives, and customer-facing design work throughout a number of groups. In the end, Samantha’s prospecting helped result in the creation of a centralized buyer insights group that unified internet analytics, market analysis, and voice of the shopper work throughout print, digital, name middle, and in-store channels.

Perspective: Making sense and making operate#section10

To this point, we’ve coated the necessity for a balanced set of consumer analysis instruments and groups, coordinating their work by orchestration, and getting them to have higher, extra productive conversations. However that’s fairly a couple of transferring components—how will we make sense of the entire?

Maps like Christian Rohrer’s panorama may also help by making sense of an setting that we’d discover giant and disorienting. You’ll additionally discover that the method of mapping is, in impact, an train in placing issues collectively that hadn’t been mixed earlier than.

However maps are additionally limiting—they’re laborious to keep up, and extra importantly, you’ll be able to’t manipulate them. To beat this, the MailChimp group took a really completely different path to sense-making, using Evernote as a shared container for consumer analysis knowledge and findings (see Aarron Walter’s article, additionally on this situation of A Checklist Aside, “Linked UX”). It’s truly an extremely purposeful set of instruments, all pointed at MailChimp’s collective consumer analysis—however, not like a map, it struggles to make visible sense of MailChimp’s consumer analysis “geography.”

Would it not make sense to mix your map and your container? Dashboards are each orientational, like maps, and purposeful, like containers. They’re additionally enticing to many leaders who, when confronted with their organizations’ complexity, search higher methods to make sense and handle. However earlier than you get your hopes up, do not forget that there’s a motive you don’t steer your automotive from its dashboard. Like another design metaphor, dashboards are inclined to collapse as we overload them with options.

Maybe some sensible group of designers, builders, and researchers will be capable of pull off some mixture of consumer analysis maps and containers, whether or not offered as a dashboard or one thing else. Within the meantime, you have to be engaged on growing each.

These themes—steadiness, cadence, dialog, and perspective—present a framework for positioning your group’s consumer analysis groups to speak, synthesize, and, in the end, provide you with extra highly effective insights. So, go make mates, have conversations, and get outdoors of your consolation zone. Take a step again and have a look at what you and your counterparts are doing—and when. Then sketch maps and different photos of which sorts of consumer analysis are taking place in your group—and which aren’t.

When you’ve carried out that, you’ll be armed to deliver senior management into the dialog. Ask them what proof would ideally assist them of their decision-making course of. Then present them your map of the imperfect, siloed consumer analysis setting that’s presently in place. Stability, cadence, dialog, and perspective may also help make up the distinction.